All Categories

Featured

Table of Contents

- – Employee Benefits Services Westminster, CA

- – Harmony SoCal Insurance Services

- – Employee Benefits Broker Near Me Westminster, CA

- – Employee Benefits Outsourcing Companies Westmi...

- – Key Man Insurance Quote Westminster, CA

- – Employee Benefits Consulting Firms Westminste...

- – Employee Benefits Consulting Firms Westminst...

- – Payroll Services For Small Business Westmins...

- – Employee Benefits Consulting Westminster, CA

- – Employee Benefits Broker Near Me Westminster...

- – Employee Benefits Broker Near Me Westminster...

- – Payroll Service For Small Businesses Westmin...

- – Employee Benefits Services Westminster, CA

- – Employee Benefits Consultants Westminster, CA

- – Harmony SoCal Insurance Services

Employee Benefits Services Westminster, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

A Qualified Client should be refining payroll with Paychex in order to receive 6 months of complimentary pay-roll services, and any unused month is not redeemable in united state money or for any kind of various other entity. The Promo just applies to pay-roll services, and Qualified Clients will be solely accountable for all fees due for services aside from payroll solutions.

We provide straight deposit and mobile pay-roll services that integrate with time and attendance monitoring. We also instantly determine deductions for taxes and retirement payments, and give skilled support to help make certain you stay compliant with all relevant policies and laws. ADP aids firms handle payroll taxes by automating reductions from worker earnings and making sure the best amount of cash is delivered to the federal government, based on the current payroll tax guidelines and laws.

ADP mobile remedies provide workers access to their pay-roll info and benefits, no issue where they are. Workers can finish a range of tasks, such as view their pay stubs, manage their time and presence, and get in time-off requests.

Employee Benefits Broker Near Me Westminster, CA

This process can be time consuming and error susceptible without the correct resources. That's why several companies turn to pay-roll solution providers for automated remedies and conformity know-how. Companies normally aren't called for to hold back tax obligations from repayments to independent contractors, which streamlines payroll processing. Nevertheless, a payroll service may still be of assistance.

Processing payroll in multiple states needs tracking, understanding and complying with the tax legislations and policies in all states where you have employees. You may also need to register your service in those states also if you do not have a physical place. Discover extra regarding multi-state conformity If you're doing pay-roll manually currently and plan to change to a pay-roll company, you need to expect to lower the moment you devote to the process.

Employee Benefits Outsourcing Companies Westminster, CA

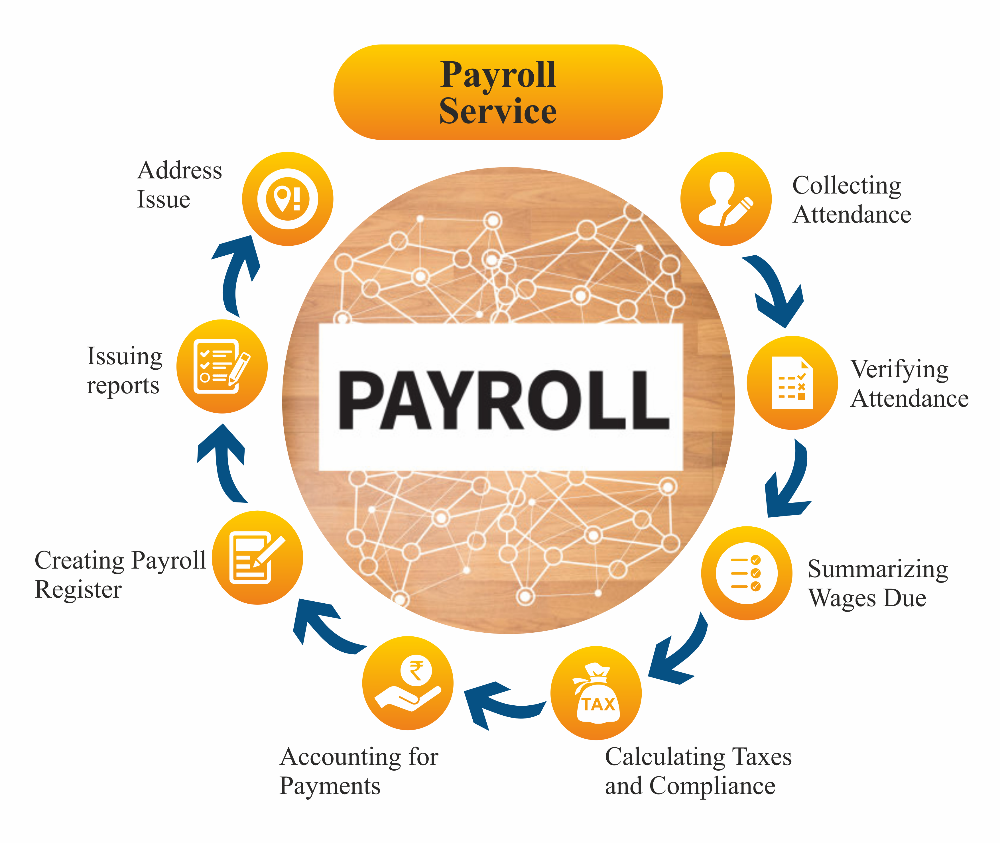

We additionally provide to countless markets, consisting of building, production, retail, healthcare and more. ADP's pay-roll solutions are automated, making it easy for you to run payroll. Here are some of the essential steps to the procedure that we'll deal with for you behind the scenes: The complete hours functioned by staff members is increased by their pay prices.

The storage might be used for marketing, analytics, and personalization of the site, such as saving your preferences (Payroll Services For Small Businesses Westminster). Privacy is crucial to us, so you have the choice of disabling particular types of storage that may not be essential for the basic performance of the site.

These items are made use of to provide marketing that is a lot more relevant to you and your passions. They may also be utilized to restrict the variety of times you see an ad and measure the efficiency of ad campaign. Marketing networks generally place them with the website driver's permission. These items permit the site to keep in mind choices you make (such as your customer name, language, or the area you are in) and provide improved, a lot more personal attributes.

These products help the website operator comprehend exactly how its internet site carries out, just how visitors interact with the site, and whether there might be technological concerns. This storage space kind normally doesn't collect info that identifies a visitor.

Key Man Insurance Quote Westminster, CA

Active employees that provided electronic authorization might now access their 2024 Kind W-2. Previous workers likewise have an alternative for an online W-2 for 2024. Visit the Accessing Form W-2 web page for info. The Payroll Solutions Division is devoted to offering accurate and prompt solutions to staff members and other stakeholders.

We have a commitment to welcome modification that advertises boosted efficiency, and we make every effort to go beyond the assumptions of our clients.

Swing pay-roll with tax filing sets you back $40 plus $6 per energetic worker or independent contractor monthly. For business outside of these states, you can select the self-service choice. In this instance, Wave determines your pay-roll taxes, but you submit the records and pay the taxes yourself. This version costs $20 plus $6 per active employee or independent professional monthly.

Employee Benefits Consulting Firms Westminster, CA

You provide them your info, and they manage the remainder, or you can make use of the pay-roll startup wizard. Paychex Flex works in all 50 states and provides 24/7 customer care, despite its base plan Paychex Flex Fundamentals. It instantly computes, data, and pays pay-roll taxes. Companies can perform payroll tasks with voice aide assimilations with Siri and Google or receive text notifications.

However, its full-service pay-roll software quickly deals with payroll for 25 and sets you back $29 month-to-month plus $7 per worker. The pay-roll provider additionally supplies self-service and family pay-roll remedies. The ideal little company payroll remedies use economical plans with core features. Nevertheless, consider your present difficulties and future requirements when selecting payroll software for your company.

Full-service pay-roll business submit tax obligations on your behalf. Payroll prices may bundle tax obligation filing, year-end kinds, and worker payments right into the base fee.

Running pay-roll is one of the most crucial and lengthy duties for little organization owners. Contracting out payroll jobs can eliminate these problems.

Employee Benefits Consulting Firms Westminster, CA

They function as an extension of your human sources (HUMAN RESOURCES) division and provide a variety of pay-roll solutions, from basic to progressed. Below, we'll review the following: Challenges of internal pay-roll handling monitoring.

Comprehending how carriers handle payroll conformity. Questions to ask a pay-roll supplier before choosing solutions. Small services encounter a number of barriers when calculating and processing worker payroll and handling taxes.

The United State Bureau of Labor Data lists the mean pay for an accounting professional as $79,880 per year, not consisting of benefits. And also, you might still make use of human resources software to procedure payroll. The IRS analyzed over $65.5 billion in civil fines in the 2023 fiscal year. Even more than $8.5 billion in penalties were imposed on firms for employment tax obligation troubles.

Companies compute the staff member's gross pay, withhold or garnish earnings as required, and send incomes. You may additionally need to conform with government and state policies, such as the Family Members and Medical Leave Act (FMLA), depending on the size of your company.

Payroll Services For Small Business Westminster, CA

These applications include Do it yourself and full-service options for running payroll and tax declaring. Can help with pay-roll. They determine worker pay and payroll tax obligations and preserve records.

Some provide licensed pay-roll reporting if you deal with government agreements. The most effective pay-roll providers update their software frequently to show work regulation changes, including guidelines for paid leave, overtime, and benefits eligibility. Lots of have built-in compliance surveillance tools and informs for tax obligation due dates and labor legislation modifications. Seek pay-roll provider that offer tax filing guarantees and committed support agents or pay-roll tax obligation compliance specialists.

Employee Benefits Consulting Westminster, CA

Likewise, see if the software application uses multistate payroll administration or worldwide options. When you meet payroll companies for an online trial or follow-up meeting, have a listing of inquiries prepared. Have a look at the supplier's most recent updates and current pay-roll fads to see if you have any type of brand-new concerns. Right here are inquiries to assist you assess performance, integration, and compliance in a little service payroll supplier: See if the provider has a precision guarantee, if it covers fines or fees, and exactly how rapidly they fix errors.

From experience, I would state that Harpers is at the top when it comes to payroll processing and tax obligation filing. Business Pay-roll Manager - 8/16 "I require to inform you that your Tax Department has actually been exceptionally useful and proactive for me.

ANYBODY I speak to in Consumer Solution is able to leap in and address my concern. From the assistant, to the consumer service people, IT team, Tax team, and specifically our Consumer Service Rep, I constantly get what I need.

Your solution to me is just the very best. I always know I can depend on you and for that I thank." Independent school.

Employee Benefits Broker Near Me Westminster, CA

By doing this, you do not need to keep an eye on every cent heading out the door. We'll also notify you of any type of check left uncashed after 180 days.

Be felt confident recognizing all your Federal, State and Neighborhood pay-roll taxes will certainly be paid promptly and compliantly. Additionally, your quarterly pay-roll tax returns will certainly be filed in a timely manner and compliantly as well as your year end pay-roll tax obligation settlements. Enjoy assurance understanding your tax obligation responsibilities are fulfilled.

On initial usage, you'll produce an individual account. If you do not have it, call your Company's Pay-roll Representative prior to trying to create an account.

The cost of tiny service pay-roll depends on numerous variables, including pay-roll regularity, overall number of employees and the particular services that are required. Many frequently, there is a per-payroll processing charge and an annual base cost. The crucial thing to bear in mind is that a payroll service may really save you money when contrasted to the expense of tax charges.

Employee Benefits Broker Near Me Westminster, CA

Whether your organization is based on the East Shore, West Coast, Midwest or one of the noncontiguous states, we've obtained you covered. You can be set up on ADP's local business pay-roll in two very easy steps: Give us with your payroll records, consisting of information about your business, your workers and their work, and state and regional laws.

ADP's little service payroll is automated, which suggests there's very little initiative needed on your part. Compute internet earnings and pay employees File tax records with government, state and local federal government agencies Paper and store pay-roll records firmly The regularity with which you can run pay-roll depends on your industry and state policies.

We'll work with you to produce a payroll calendar that fits your business and conformity requirements. Depending upon your state's guidelines, your employees may be able to access their pay statements online. Or, you may be called for to give them with printed pay declarations. ADP's local business pay-roll supports both versions.

The year is 2025, and the buzzwords in the work environment are health, equilibrium, interaction, and, of program, ...

While doing this, she worked in multiple other industries such as real estateActual property managementBuilding architecture, design marketing, advertising othersAmongst Her locations of particular competence are leave administration, process, conformity, plan and administration, client interaction, employee connections, pay-roll, and recruiting.

She constantly informs herself on conformity and stays up to day on brand-new policies and laws nationally and at the state, region, and regional levels.

Payroll Service For Small Businesses Westminster, CA

Small business payroll usually results in a big frustration as managers and owners learn just how to do payroll by hand., your payroll estimations are automated.

Today's manager have much more on their plate than everand locating the ideal payroll firm should not be just one of them. We reside in a complicated globe of 'Big Information.' While the tools to help achieve job are as advanced as they have ever before been, the average employee today still usually reports feeling worn, helping to drive the record resignations of the last several years.

Even if you currently have the best team in area, without the right tools, job will certainly be duplicated, effort squandered and frustrations mounted. That's why selecting the best payroll firm for you and your staff members is vital to running your company like a well-oiled machine. Below's a list of the top 20 Pay-roll Business running today and what you need to understand about them: Whatever provider you select, the best payroll business for your organization's demands relies on its specific objectives, customers, clients and workers.

Employee Benefits Services Westminster, CA

1IMPORTANT INFO FOR OPENING A CARD ACCOUNT: To assist the federal government battle the funding of terrorism and money laundering tasks, the U.S.A. PATRIOT Act requires us to get, confirm, and record details that determines everyone who opens up a Card Account. WHAT THIS INDICATES FOR YOU: When you open a Card Account, we will ask for your name, address, date of birth, and your federal government ID number.

Card activation and identity confirmation needed prior to you can utilize the Card Account. If your identity is partly confirmed, full use of the Card Account will certainly be limited, yet you may be able to utilize the Card for in-store acquisition transactions and ATM withdrawals. Limitations include: no worldwide purchases, account-to-account transfers and additional loads.

Employee Benefits Consultants Westminster, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID confirmation and funds availability. Deal costs, terms, and problems apply to the usage and reloading of the Card Account. See the Cardholder Agreement for information. Mastercard is a registered trademark, and the circles layout is a hallmark of Mastercard International Incorporated.

Employee Benefits Broker Near Me Westminster, CAEmployee Benefits Consultants Westminster, CA

Employee Benefits Company Westminster, CA

Find A Good Seo Near Me Westminster, CA

Finding A Seo Marketing Westminster, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Services Westminster, CA

- – Harmony SoCal Insurance Services

- – Employee Benefits Broker Near Me Westminster, CA

- – Employee Benefits Outsourcing Companies Westmi...

- – Key Man Insurance Quote Westminster, CA

- – Employee Benefits Consulting Firms Westminste...

- – Employee Benefits Consulting Firms Westminst...

- – Payroll Services For Small Business Westmins...

- – Employee Benefits Consulting Westminster, CA

- – Employee Benefits Broker Near Me Westminster...

- – Employee Benefits Broker Near Me Westminster...

- – Payroll Service For Small Businesses Westmin...

- – Employee Benefits Services Westminster, CA

- – Employee Benefits Consultants Westminster, CA

- – Harmony SoCal Insurance Services

Latest Posts

Encinitas Residential Plumbing Companies Near Me

Residential Plumbing Companies Near Me Fairbanks Ranch

Slab Leak Repair Torrey Hills

Latest Posts

Encinitas Residential Plumbing Companies Near Me

Residential Plumbing Companies Near Me Fairbanks Ranch

Slab Leak Repair Torrey Hills